Manulife Under Fire: Widespread Complaints Over Denied Claims and Customer Neglect

CALGARY, AB Across Canada, from Calgary to Toronto, a growing number of Manulife policyholders are coming forward with alarming stories of denied claims, paltry payouts, and negligent customer service. Despite years of loyal premium payments, many Canadians feel abandoned at their most vulnerable moments. Action News digs deep into these claims, exposing the systemic issues that have left policyholders in financial distress and emotional turmoil.

A Pattern of Deception: The Manulife Claims Nightmare

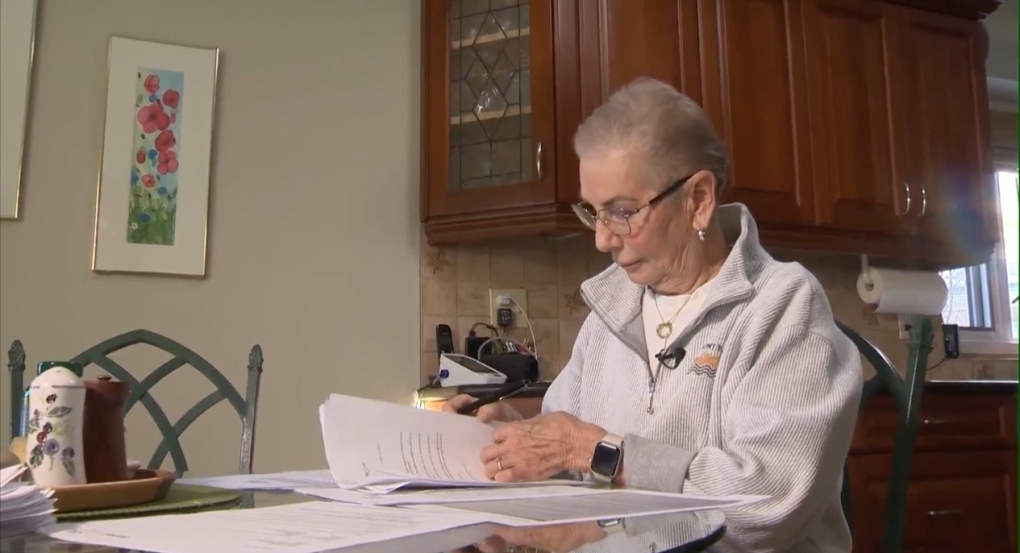

One Calgary resident, a Manulife policyholder for over 20 years, describes an infuriating experience with the insurance company. Despite paying $100 monthly premiums for nearly two decadesamounting to over $24,000they received a mere $1,000 in claims payouts. This grossly unfair discrepancy highlights a shocking truth: for many, Manulifes promises are nothing more than empty words.

For this individual, the denial of claims has not only caused financial strain but also significant emotional distress. "I felt completely let down by Manulife. They promised support during my difficult times, but instead, I was left to struggle on my own," they shared.

National Outcry: Manulife Faces Backlash

Manulifes failures are far from isolated cases. National news outlets have reported on several heart-wrenching instances of Canadians struggling to access the coverage they paid for:

- A Calgary woman had her claims for mental health treatment denied by Manulife, raising concerns about discriminatory practices against vulnerable policyholders.

- A B.C. man battling stage 4 cancer was shockingly denied critical coverage, leaving him to face an overwhelming financial burden while battling a life-threatening illness.

These are just two of many stories that paint a disturbing picture of Manulifes practices, highlighting a troubling trend of denials, delays, and dismissals in its claims process.

Policyholders report that the denial of claims often lacks transparency, leaving them without clear explanations or pathways to appeal. "It's frustrating not knowing why my claim was denied or what I can do next," another policyholder expressed.

The Ineffectiveness of the Ombudsman

Manulife advertises its Ombudsman service as a resource for customers seeking resolution. However, many policyholders describe the Ombudsman as a bureaucratic dead-end. Instead of advocating for clients, the office often appears to prioritize shielding the company from accountability. Customers report vague responses and little to no action taken to address their concerns, leaving them with nowhere to turn.

Many policyholders feel that the Ombudsmans role is merely performative, with little actual impact on their cases. "I reached out to the Ombudsman, hoping for help, but all I got was a generic response with no real assistance," shared a frustrated customer.

The Financial and Emotional Toll on Policyholders

The financial impact on policyholders is staggering. Many families have been forced to delay treatments or pay for medical expenses out-of-pocket. Some have even faced financial ruin due to Manulifes denials. Beyond the monetary impact, the emotional toll is severeparticularly for those already dealing with critical health conditions or emergencies.

One affected family described the experience as a "nightmare," stating that the lack of support from Manulife forced them to make heartbreaking decisions regarding their loved ones care.

Calls for Accountability

Policyholders and advocacy groups are now calling for increased oversight of the insurance industry in Canada. They are demanding transparency in claims processes and enforcement of accountability for companies like Manulife. Provincial and federal regulators are being urged to investigate these practices and implement reforms to protect consumers.

The Role of Legal Advocates: Fighting for Fairness Against Manulife

Amid widespread complaints about Manulife's handling of long-term disability claims, a dedicated group of legal professionals is stepping in to support affected policyholders. Injured.ca, a law firm specializing in personal injury and insurance disputes, is taking a stand against the insurance giant, providing critical assistance to individuals who have been wronged by Manulife's practices.

For many Canadians, the road to justice feels overwhelming. Facing a corporate giant like Manulifeone of Canadas largest insurerscan feel like a David vs. Goliath battle. However, the team at Injured.ca is committed to ensuring that policyholders do not face this fight alone. By offering personalized legal counsel and fighting for policyholders rights, the law firm is empowering individuals to take action against unfair denials and seek the compensation they deserve.

How Injured.ca is Helping Policyholders

Injured.ca is offering free consultations for those who have had their long-term disability claims denied by Manulife. The firms team of seasoned lawyers is dedicated to identifying the grounds for legal action, whether its a case of improper claims handling, discriminatory practices, or failure to uphold contractual obligations. They focus on securing:

- Full Claim Payouts: Ensuring policyholders receive the full benefits they are entitled to under their insurance policies.

- Compensation for Emotional Distress: Helping clients claim damages for the emotional and psychological toll caused by the denial of benefits, especially in cases involving serious health conditions.

- Class Action Lawsuits: Exploring options for collective legal action, so individuals arent alone in their battle against a corporate entity with vast resources.

The firm has already seen significant success in bringing claims against insurers like Manulife, recovering millions of dollars for wronged policyholders. For many, their intervention is the only way to break through the corporate red tape and receive the coverage they were promised when they purchased their policies.

Why Choose Injured.ca?

Injured.ca brings more than just legal expertise to the tablethey bring empathy, a personalized approach, and a proven track record of success. Their team of insurance dispute lawyers is deeply familiar with the tactics that large insurance companies like Manulife use to avoid paying legitimate claims. By understanding the full scope of the issue, they are able to devise targeted legal strategies that help policyholders secure favorable outcomes.

Additionally, Injured.ca is committed to a no-win, no-fee policy. This means that affected policyholders can pursue their claims without the burden of upfront legal fees. If the firm does not win the case, theres no cost to the client, which eliminates the financial risk often associated with legal action.

What Policyholders Are Saying

Many clients who have worked with Injured.ca speak highly of the firms dedication and results:

I thought I had no chance of getting my benefits after Manulife denied my claim. But Injured.ca fought hard for me, and today, Im getting the compensation I deserve. I cant thank them enough for their hard work and support.

For more information about how Injured.ca can help you or to schedule a free consultation, visit their website at Injured.ca or contact them directly at info@injured.ca.

Action News: Advocating for Justice

Action News is committed to amplifying the voices of affected policyholders and holding corporations accountable. Manulife must address these allegations, ensure fair treatment of its customers, and offer refunds or settlements to those who have been wronged. The trust of countless Canadians depends on meaningful action to rectify these failures.

If youve experienced similar issues with Manulife or any other insurer, we want to hear your story. Contact us at legal@westnet.ca.

Advisory: Protecting Your Financial Interests

If you have faced denied claims or insufficient payouts from Manulife, its crucial to take proactive steps to protect your financial interests. We advise policyholders to:

- Contact Your Credit Card Issuer: If you believe unauthorized charges have been made or if you need to dispute charges related to denied claims, reach out to your credit card issuer immediately to report and dispute these transactions.

- Keep Detailed Records: Maintain comprehensive records of all communications with Manulife, including emails, letters, and phone call logs. This documentation will be invaluable if you decide to seek legal assistance.

- Seek Legal Counsel: Consider consulting with legal professionals like those at Injured.ca who specialize in insurance disputes. They can provide expert advice and help you navigate the complexities of your case.

- Report to Regulatory Bodies: File complaints with provincial or federal insurance regulatory bodies to ensure that your grievances are formally acknowledged and addressed.

By taking these steps, you can better protect yourself and increase the likelihood of a favorable resolution to your claims issues.